Award-winning PDF software

How to prepare Form I-9

About Form I-9

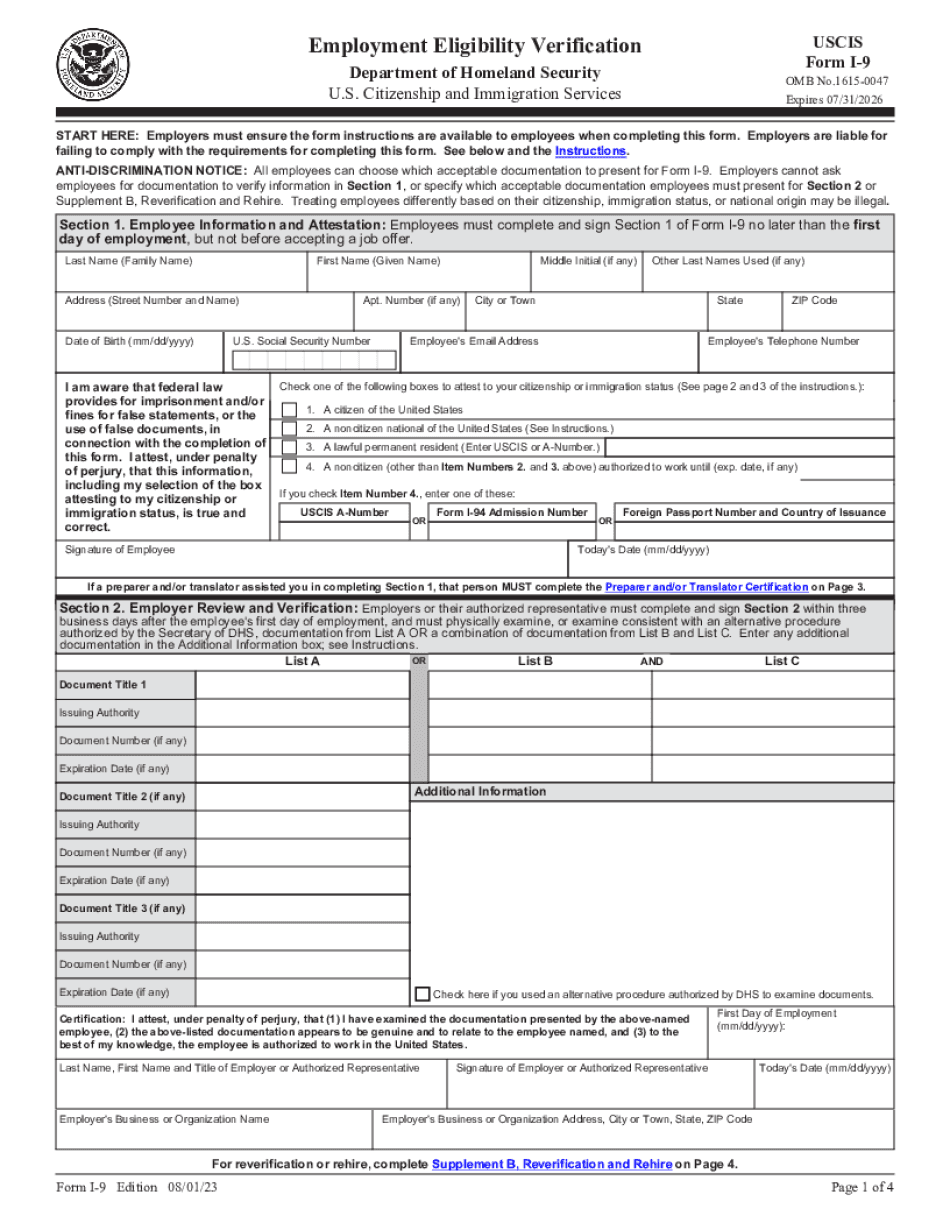

Form I-9 is an employment eligibility verification form that is used to verify the identity and employment authorization of individuals hired for employment in the United States. It is required by the United States Citizenship and Immigration Services (USCIS) and is used to ensure that employers hire only individuals who are authorized to work in the United States. All employers in the United States, including employers of remote workers, must complete an I-9 for each employee, regardless of their citizenship or immigration status. Both the employer and the employee must complete the form, and documentation must be provided to prove the individual's identity and employment eligibility.

What Is I 9 Form?

I-9 form is an Employment Eligibility Verification. It is intended for verifying individual`s identity and employment authorization in order to be employed in the U.S.

An employer has to ensure the proper completion of a form by an individual. Such form has to be obligatory filled out by both employer and employee.

In addition to I-9 an individual has to pran employer with documents confirming his/her identity and eligibility to be employed. Further an employer will inspect these documents if they are genuine and valid and record document related information on the form. A person may find the list of required documents on the last page of a document.

The important fact is that fillable I-9 form doesn`t require a social security number to be provided and excludes any filing fee.

A blank I-9 form sample is divided into 3 sections and consists of three pages. First two pages present the document itself and the last one includes list of documents requested to be attached for preparing a form in PDF. Before completing a document it is vital to read all specified instructions provided in each section in order to duly prepare a document .

First section is usually completed by employee on the first employment day and comprises his/her personal and status details. It has to be signed mandatory by an individual.

Section 2 provides information regarding verification of individual`s documents by an employer or his authorized representative and it is to be completed within three days of the employee`s first employment day. It includes details about document`s date of issue, expiration date and issuing body. After completion this section is to be signed by an employer.

Section 3 is designated to reverification and rehires and it is completed and signed by an employer. By signing the two last sections an employer confirms that an abovementioned individual is eligible to work in the U.S. and his/her documents appear to be legal and valid.

Examine attentively a list of documents needed in order verification procedure to be smooth.

Online answers enable you to organize your doc management and enhance the productiveness of your respective workflow. Comply with the quick guidebook to be able to entire Form I-9, prevent glitches and furnish it inside of a well timed method:

How to finish a I9 Form?

- On the website together with the variety, click Launch Now and move towards the editor.

- Use the clues to complete the related fields.

- Include your individual knowledge and make contact with data.

- Make certainly that you enter suitable information and facts and figures in appropriate fields.

- Carefully check out the written content of your kind in addition as grammar and spelling.

- Refer to support area in case you have any doubts or deal with our Support workforce.

- Put an digital signature on the Form I-9 while using the help of Indication Device.

- Once the form is done, press Accomplished.

- Distribute the prepared variety through e-mail or fax, print it out or preserve on your own device.

PDF editor will allow you to definitely make adjustments to your Form I-9 from any online linked product, personalize it in keeping with your needs, signal it electronically and distribute in numerous ways.